Context

LendingClub, unlike typical banks, prioritizes its members' financial health and provides tailored solutions.

Objective

Develop a multi-product experience that caters to the financial needs of its members.

Discovery

Ethnographic research was carried out to identify target customers and understand their challenges, needs, financial objectives, and aspirations.

13

Current Members Interviewed

29-56

Mix of Ages

$15k-$200k

Mix of Annual Income

Interviews

Interviews revealed customers often struggle to find the best way to manage their debt and minimize interest payments.

Key Insights

Key issues the new app should address:

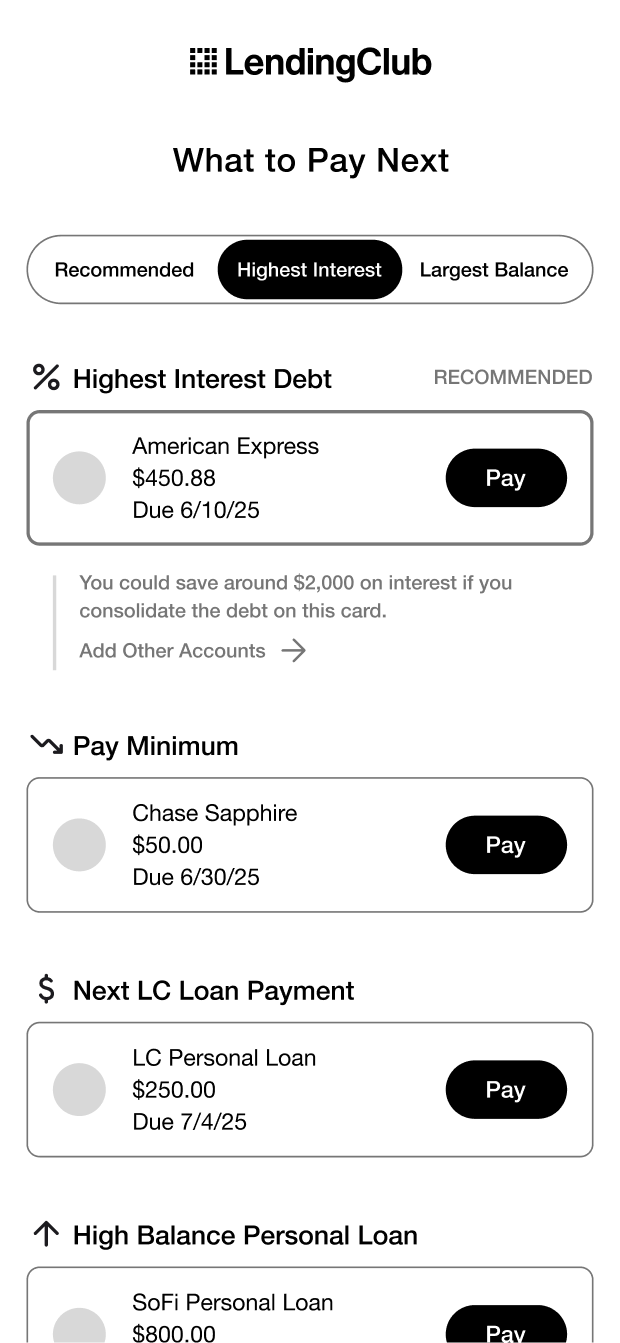

- Obtaining a comprehensive overview of debt, including key details like APRs and payment timelines.

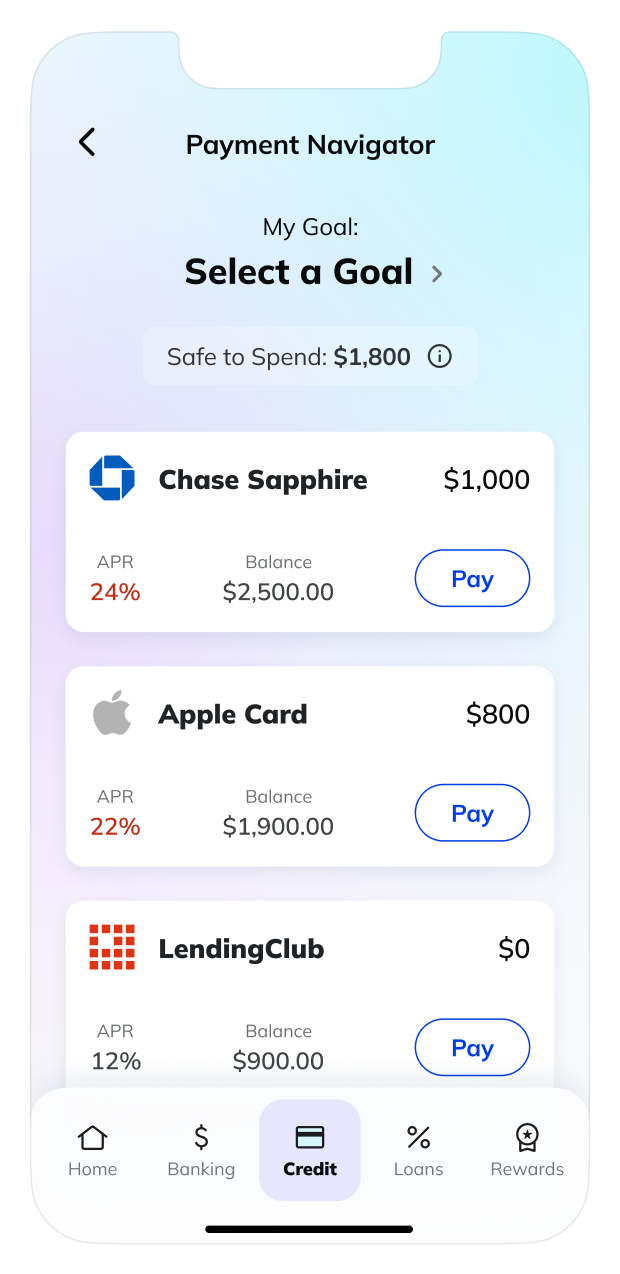

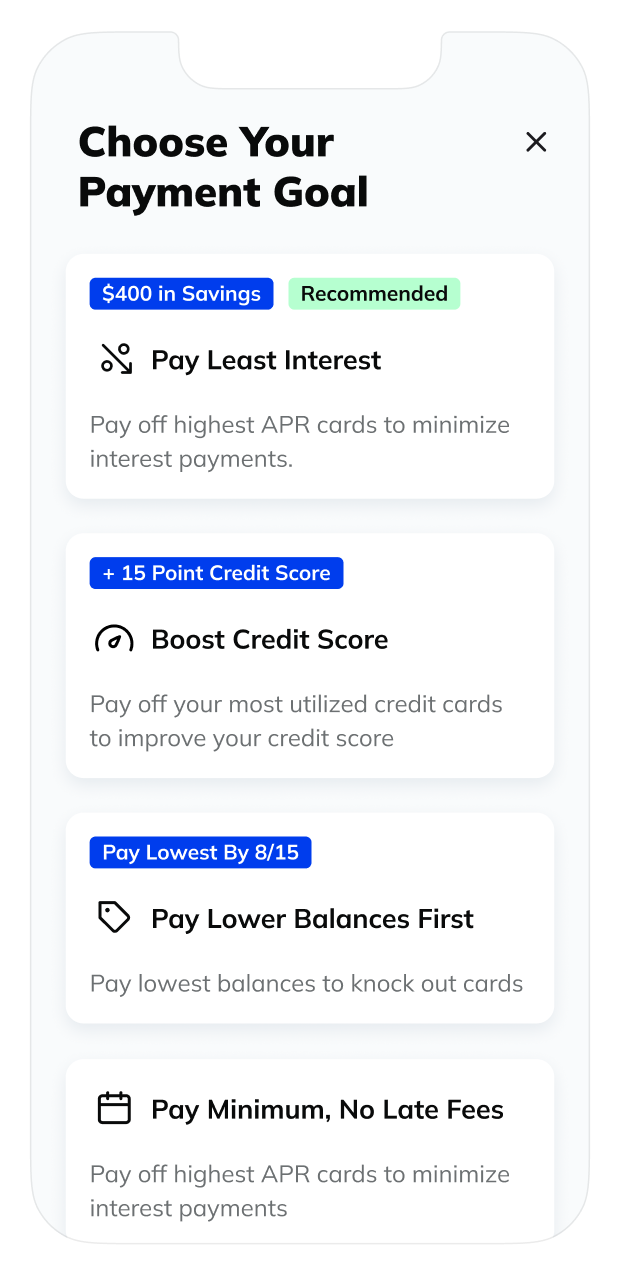

- Streamlining debt payments to minimize interest costs and analyzing the best payment strategy.

- Achieve more than just financial stability.

Wireframes

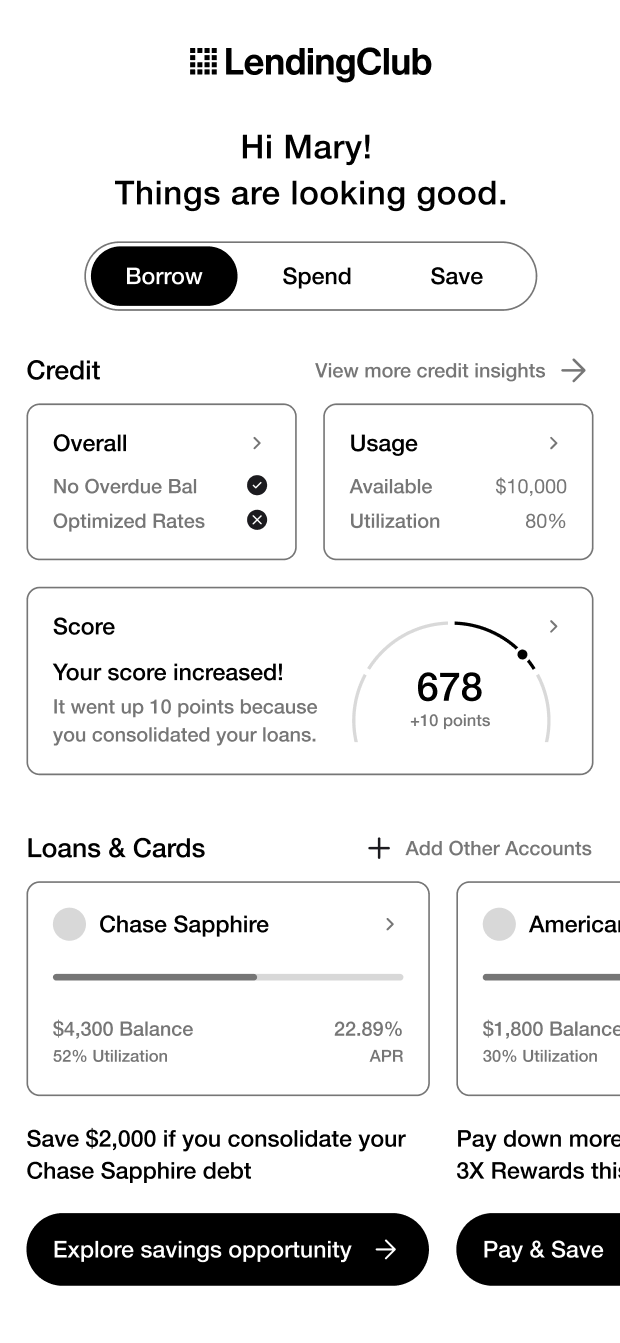

The new app features a dashboard that displays credit scores and suggests repayment strategies.

Loan optimization is offered for both LendingClub loans and those from other banks.

The user can check the app regularly for advice on which debts and credit card payments to prioritize.

This simplifies decisions for users while ensuring they retain control over bill payments.

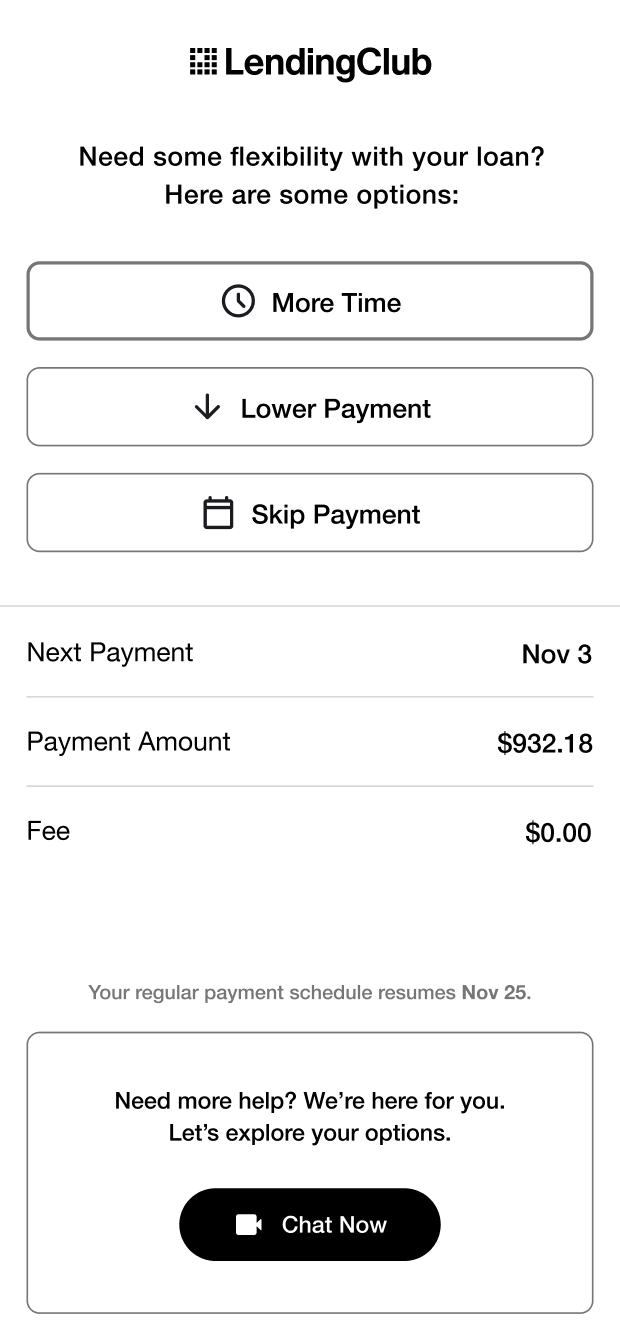

The app provides flexibility for unforeseen expenses, ensuring

members can consistently meet loan payments.

Final Design

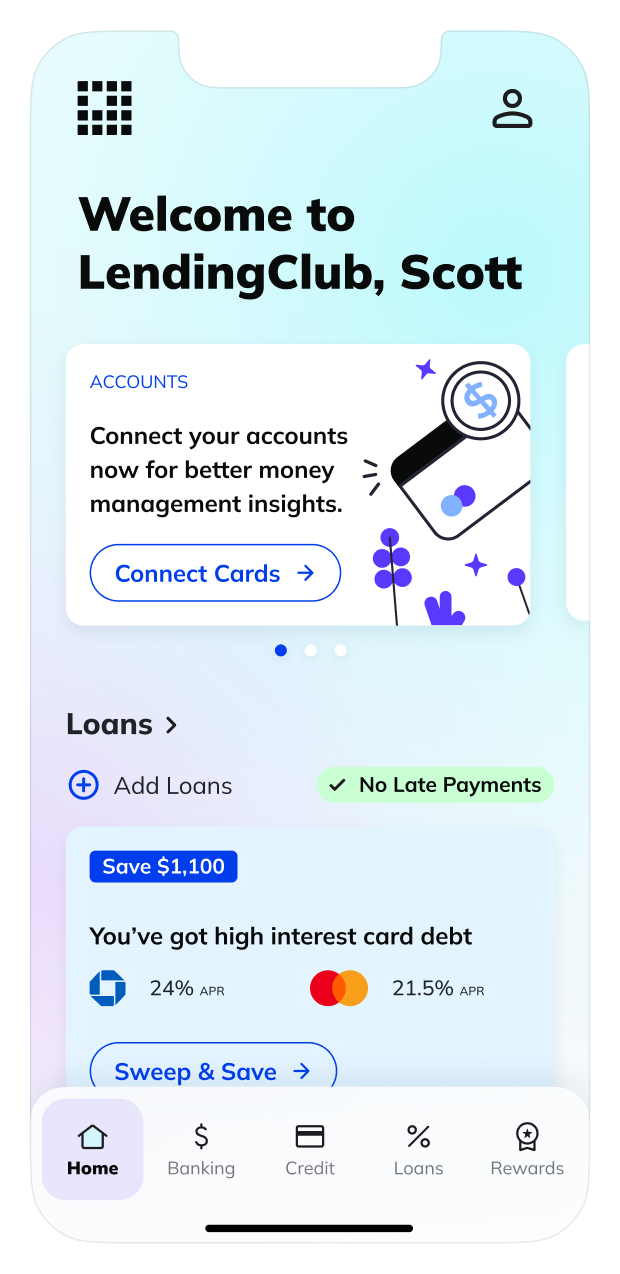

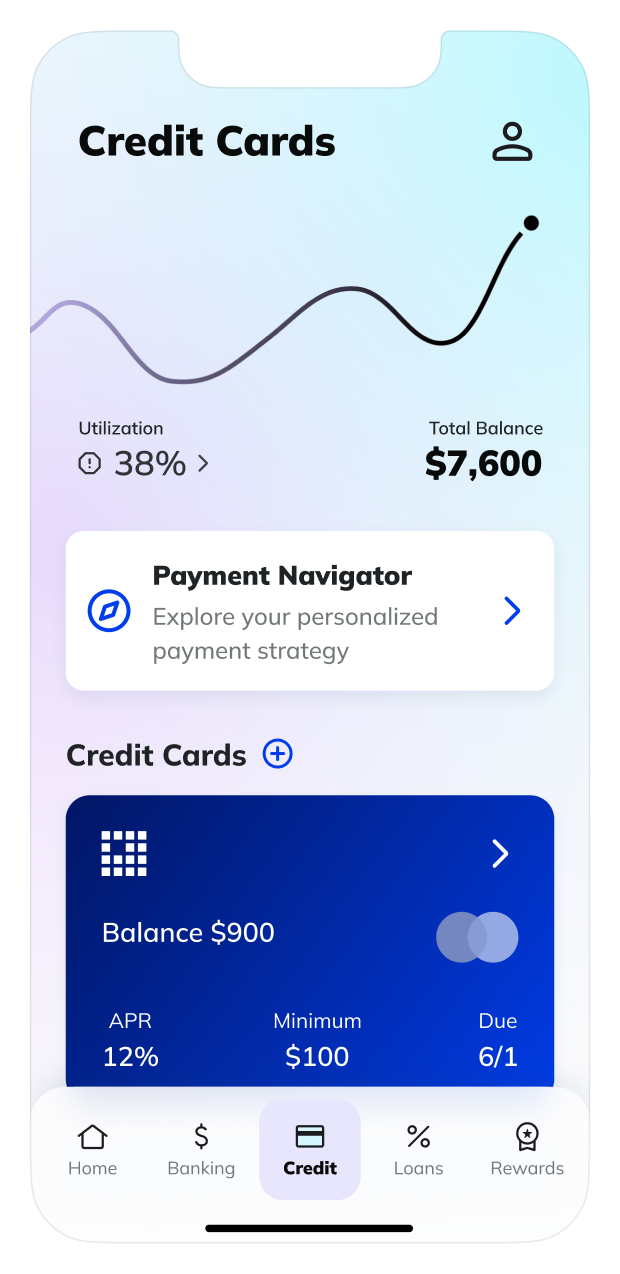

When users launch the app, a dashboard displays an overview of their debt, credit health, and total finances all in one view.

By managing credit cards and loans in one place, users gain deeper insights into their financial health.

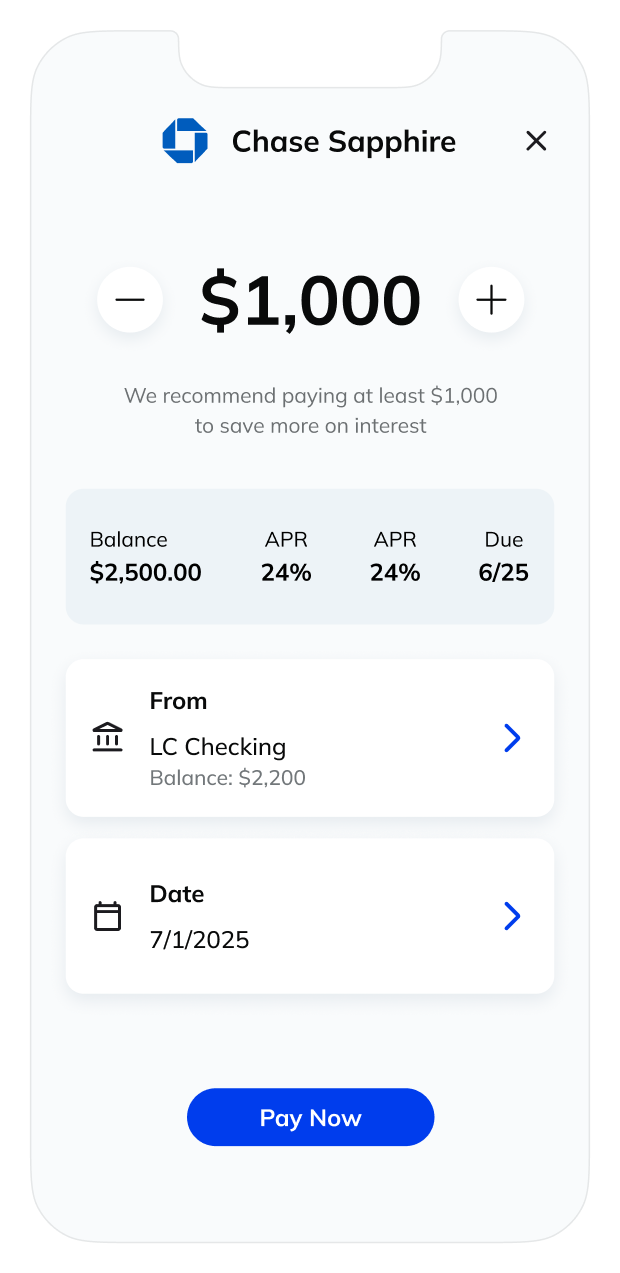

All loans can be paid from the app for a more streamlined experience.

Recommendations are automatically and proactively provided.

Ultimately, the user always gets to decide on the payment amount.

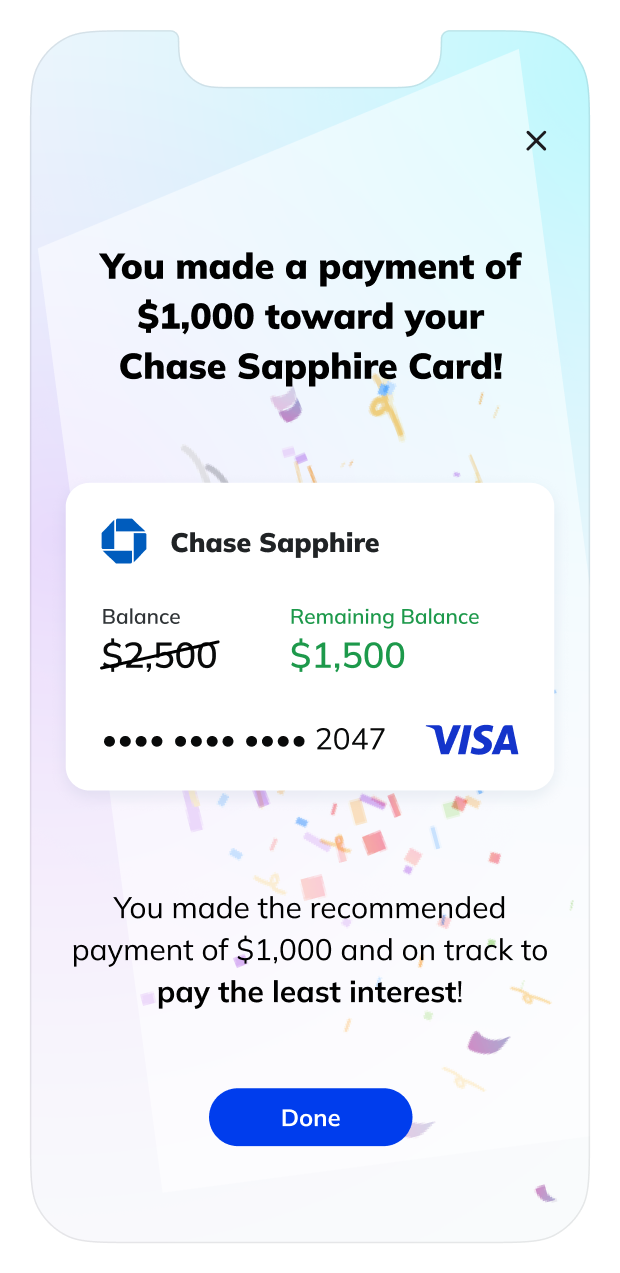

The app celebrates each payment, not just the final payoff.

Outcome

The app is being actively developed and tested, with a planned release in Q2 2024.